What to Know About the Market

With mortgage rates inching up and prices still climbing, there is a shift from the “anything goes” housing market we saw the last two years. Here are some takeaways from what I’ve recently been reading.

The market is not about to crash. It appears to be a turning point towards more typical pre-pandemic levels. Mark Fleming, chief economist at First American says “. . . today’s housing market looks a lot like the 2019 housing market, which was the strongest housing market in a decade at the time.”

- Demand for housing exceeds the current supply. The US has underbuilt single family housing by 4.3 million units since 2000. Households are forming faster than builders can create new housing. This deficit is predicted to continue over the next 10 plus years. This will continue to drive prices up.

- The rate of appreciation is expected to slow – but not drop. The expectation is in a year from now, prices will be higher than they are currently.

- Lenders are vetting buyers more stringently, unlike the last housing bubble. Over 70% of mortgage dollars are to buyers with 760+ credit scores, compared to pre-2008, when that number was under 25%.

- If you don’t plan to be in your home for more than 5 yrs. or so, buyers should consider a 5-yr. adjustable rate mortgage, which has a lower interest rate than a 30-yr. fixed.

The market is shifting. Whether buying or selling, contact me to help you navigate these changes.

Donna Forest ~ donna@donnaforest.com ~ 603-731-5151

Are Multiple Offers Still the Norm?

Despite rising mortgage rates, multiple offers are still prevalent according to the March Realtors Confidence Index Survey. In this survey, Realtors reported an average of nearly 5 offers on each home that sold in March. Home buying demand is still outpacing supply. The shortage of homes for sale will continue to make this a competitive market for buyers. Gay Cororaton, research economist at the Nat’l Assoc. of Realtors, writes “…properties typically stayed on the market for a shorter time compared to one year ago, at 17 days on the market. Eighty-seven percent of listings were on the market for less than one month.” In NH thru March 2022, homes typically stayed on the market for 34 days.

How tight is the inventory? At the end of March there were 950,000 homes on the market, equivalent to a 2 months supply. A normal market is about 6 months - meaning the inventory of homes on the market should be at 2.9 million. Doing simple math, there is a shortage of about 2 million homes for sale in the US. Due to this tight supply, the Nat’l Assoc. of Realtors expects prices to continue to appreciate by about 5% by year-end. If you are looking to buy or sell, contact me to help you navigate the complexities of this market!

Donna Forest ~ donna@donnaforest.com ~ 603-731-5151

What is Your Home Worth?

In this unique sellers’ market, it seems like you can put any crazy number on a house and it will sell. In reality, determining market value is still crucial if you are serious about selling. Overpriced properties take longer to sell and sell for less than if priced correctly from the start. Below are the common approaches for determining value.

- Automated Valuation – Companies like Zillow calculate value using software based on mathematical modeling. While convenient, it is not accurate. It misses important price influences such as property condition and location (e.g., it can’t see your brand new kitchen or if on a busy street).

- Appraisal – An in-depth analysis by a licensed appraiser and is typically used in the loan process. Right now bidding wars are driving sales prices up higher than other recent sales. Since appraisals rely heavily on past comparable sales, this lagging data can make it difficult to capture the current market.

- Market Analysis - Prepared by a realtor to provide a probable listing price. Using similar active and recently sold properties and factoring in the many characteristics that impact value.

Of note, assessed value is for tax purposes and may not reflect fair market value. Also, there is no correlation between the cost of building vs. how much your house is worth. Want to know your home’s value? Contact me - 28 yrs. in the business and still keeping current. Put my knowledge to work for you!

Donna Forest ~ donna@donnaforest.com ~ 603-731-5151

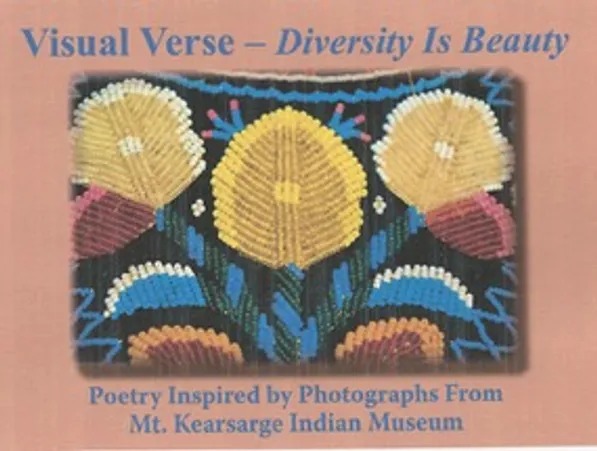

April 7th "Diversity is Beauty" 6:00

Poetry read by the poets while viewing the artifacts which inspired the poems!

Visual Verse IV "Diversity is Beauty" at the Mt Kearsarge Indian Museum-Warner

This exquisite book is a collection of beautiful photos submitted by the

Mt. Kearsarge Indian Museum, depicting many dimensions of Native American life and culture and the poems inspired by the images.

Source-

Are Home Prices Still Going Up?

Given the war in Ukraine, rising mortgage rates, COVID, inflation at 7.9%, etc., you might be wondering if home prices will still be increasing or if we are in a housing bubble that might burst at any moment. We are definitely NOT in a housing bubble. It is simply the law of supply and demand at work where there are more buyers than houses for sale. The lack of inventory means buyers will be forced to bid up prices if they hope to land a home. In NH, new listings are down 17% thru Feb., the volume of sales is down 17.7% and the median sales price at $400,000 is up 14% compared to the first two months in 2021. Back in Dec., economists were predicting home prices to rise at a more moderate rate between 5% and 6%. Zillow is now predicting prices to be up 17.3% at year end. While it’s difficult to really say how much increase there will ultimately be, the forecast is definitely upwards as spring is shaping up to be one of the hottest markets yet. Home ownership builds wealth – a homeowner’s net worth is 40x greater than that of a renter. It also is one of the best investments against inflation. Whether a first-time buyer or looking to sell to buy a home that better suits your needs, waiting will cost you. Contact me to find out what steps you should be taking now.

Donna Forest 603.731.5151~donna@donnaforest.com

MAR

25

JOEL CAGE

Joel Cage is an award winning veteran singer/songwriter from Boston. Once a member of the internationally acclaimed rock & roll group Southside Johnny & the Asbury Jukes, Joel has been performing regionally and nationally as a soloist for the past 2 decades. He has performed at some of the most prestigious folk & acoustic venues & festivals in the country, including the Kerrville Folk Festival in Texas where he was awarded top prize in the Kerrville New Folk Competition.

A virtuoso guitarist and an impassioned vocalist, Joel Cage's music is both evocative and raucous. He spans the gamut from sounding like a full rock band to 'hear your own heartbeat' intimacy.

Joel Cage is also a master interpreter of other people's music, spanning a wide field of musical genres, garnering him the oft used moniker "Acoustic Rock Song Stylist."

SOURCE: Sunapee CoffeeHouse

11

OPEN MIC NIGHT

The Tradition continues, Stop by to listen or join in. Sign up on site with the host for your 15 min or three songs. Storytellers also welcome!

Tonight‘s Emcees:

Al Carruth & EJ Tretter

18

THE WHITE MOUNTAIN CEILI BAND

White Mountain Ceilí Band is Dexter Harding on the tenor banjo, Fiona Howell on the flute, Siena Kaplan-Thompson on the fiddle, and Mike Levine on the guitar and occasional concertina. They play Irish, Scottish and Cape Breton instrumental music with warmth and joy, as well as the occasional song.

Dexter first came to Irish music when he played for contra dances around the valley, and the session at May Kelly’s deepened his focus on the Irish tradition.

Fiona grew up playing flute through Mountain Top Music Center, and went on to study music at Loyola University. While in New Orleans she began playing at Irish sessions, and now plays and sings with a few groups around New England.

Siena grew up playing classical violin and viola and switched to fiddle in college when she discovered the Boston Scottish and Cape Breton music scene.

Mike has played a wide range of musical styles, from classical to rock, and more recently bebop. He and Siena have both enjoyed branching out into Irish music with the White Mountain Ceilí Band.

Here's a sneak preview of The White Mountain Ceili Band

Tonight‘s Emcee:

TBD

Source: Sunapee CoffeeHouse

Dine Local

Take a look at these businesses offering Take Out, Delivery, Curbside Pick Up, Online Orders and more...

Andover

The Refinery - https://www.refinerynh.com/

Bradford

The Appleseed - http://appleseedrestaurant.com/

Sweet Beet Market - http://www.kearsargefoodhub.org/sweet-beet-market

Newbury

Bubba's Bar & Grille - https://bubbasbarandgrille.com/menus/

The Shanty - Salt Hill - https://www.salthillpub.com/

New London

Grounds - https://www.facebook.com/374mainst/

Blue Loon Bakery - https://www.blueloonbakery.com/

Tuckers - https://tuckersnh.com/

Flying Goose - https://www.flyinggoose.com/

Inn at Pleasant Lake - https://innatpleasantlake.com/nh-restaurant-fine-dining.html#to-go-menu

Pizza Chef - https://pizzachef.com/new-london-nh-pizza/

Sunapee

The Anchorage - https://www.anchoragesunapee.com/

Other Locations

Salt Hill Pub in Newport & Lebanon - https://www.salthillpub.com/

SOURCE: Lake Sunapee Region Chamber of Commerce

FEBRUARY 18th

THE MILKHOUSE HEATERS

In the early days, Mike played bass while Jan sang lead and played guitar. They could often be found kicking around the Boston music scene. They received airplay on several of the city’s radio stations and were nominated for a Boston Music Award in 2001. They have shared the stage with The Black Crowes, Corey Glover, Fuel, Feeder, and Hum as well as playing the Boston leg of The Vans Warped Tour. Their songs are on numerous compilations alongside the likes of G. Love and Special Sauce, Jack Johnson, Burning Spear, and The Mighty, Mighty Bosstones. Their music has been licensed to television shows on ABC, VH1, MTV, ESPN, and ESPN 2.

Mike and Jan bought land in rural Vermont in 2003 and started building their home, doing most of the work themselves. This is where the humble seeds of The Milkhouse Heaters were planted. Mike bought an acoustic guitar, and began writing Americana songs. With Jan on bass, they honed their sound and played their first show as The Milkhouse Heaters in 2010.

Mike and Jan have added several notches to their musical belt, including closing for Billy Bragg as part of a WOOL Black Sheep Radio fundraiser and opening for Fred Eaglesmith at The Shoulder to the Plough concert, which benefitted the farmers devastated by Hurricane Irene. Two of their songs are featured on The Shoulder to the Plough CD, which was recorded live at the Rockingham Meeting House in 2011. Since then, The Milkhouse Heaters have been playing nearly every weekend around New England and were invited to play the 14th Annual Roots on the River Festival.

Source: sunapeecoffeehouse.org

Don’t Wait Until Spring to Sell!

If you are thinking of selling and waiting for spring, you might want to re-think your timing. Yes, historically 40% of home sales occurred between April and July. However, we still are not in a normal year and the number of homes on the market is extremely low. Here are 5 reasons to list now versus wait for spring

- Buyers are out looking in full force and ready to buy. Multiple offers are the norm which means prices are up.

- The average homeowner gained $56,700 in equity over the past 12 months according to CoreLogic. This may be just what you need to cover a down payment on your next purchase.

- Fewer homes for sale translates to less competition - you can negotiate for the best price and terms now.

- Mortgage rates, while rising, are still far below what they’ve been in recent decades. Lock in a low interest rate now as experts are projecting rates will continue to rise.

- If you’re selling to move into a bigger home or downsize, prices are expected to go up in 2022. Move now and beat the higher interest rate and price climb.

If you are wondering if now is a good time to list your house and want to know more about the next steps, contact me to learn how you can take advantage of the current market conditions.

Contact Donna Forest, Donna@DonnaForest.com, 603.731.5151