Lot 2 Granite Ridge Road, Sunapee, NH 03782 | Offered at $275,000 | MLS #4995742

VIEW lot in the desirable Granite Ridge Rd. neighborhood. Prime location on a dead-end paved road and only minutes to downtown New London, the beach at Georges Mills and only 10 miles to skiing at Mt. Sunapee. Panoramic views include Mt. Sunapee and its ski trails with potential lake views with more tree cutting. The lot is 5.5 acres with a gentle upward slope from the street to a flat building site for easy building. There is an onsite well producing 15 gpm and underground power to the lot. View easements ensure the continuation of the delightful vistas.

For More Information Contact:

|

Donna ForestAssociate BrokerM 603-731-5151

|

127 Hilltop Place, New London, NH 03257 | Offered at $495,000 | MLS# 4995100

Enjoy the privacy of no adjacent neighbors, and the comfort and ease of one floor living in this attractive and roomy free-standing Hilltop condominium. With approximately 2,200 sq. ft. of living space, you won’t feel like you are down-sizing much at all. You will also love the extras which include a sunroom, den with built-ins, primary bedroom with private bath, a lovely, truly eat-in, updated kitchen and a gracious living/dining room with fireplace. Located centrally in the Hilltop community, everything you need is close at hand, plus you have the enjoyment of a large open field across the road. This is a special opportunity as there aren’t many single units to be had at Hilltop.

For More Information Contact:

|

Marilyn Kidder

W (603) 526-4116

|

7 Bay Tree Lane, Grantham, NH 03753 | Offered at $349,900 | MLS #4994869

Water views and a short walk to West Cove beach with this 3 bedroom, 2 bath condo! Kayak/canoe access to Eastman Lake is just across the path. Enjoy resort living all year round in the recreational community of Eastman. Golf, hiking, tennis, fishing, swimming, fitness center and more. The sunny living room is the perfect place for relaxing with a good book. A large deck offers plenty of space for outdoor entertaining. There are three levels of living space (partially finished lower level) so everyone can spread out. Most likely you will be out enjoying the many amenities offered in Eastman. Take advantage of carefree living in this relaxing retreat. (All existing furnishings will be left).

For More Information Contact:

|

Donna ForestAssociate BrokerM 603-731-5151

|

- A BRAND WITH A LEGACY ®

It’s more than just a name you know, it’s a name you trust. The Better Homes & Gardens brand has been a trusted source for homeowners, buyers and sellers since the 1920’s. - AUTHENTIC CONNECTIONS

The Better Homes and Gardens Real Estate brand comes with a network like no other; which means more connections to potential buyers and sellers for your next home transaction. - PASSIONATE PROFESSIONALS

We are affiliated with a network of over 12,000 affiliated real estate professionals who are united by common core values and compassionate culture… all with the main goal to serve YOU! - A BRAND FOR YOUR LIFESTYLE

We know that you are not buying a home but buying the home in which to live your best life in; our unique tools allow us to help you in that process. - EXPECT BETTER®

Our promise to you: to bring all the skills, credibility and marketing power that you would expect from a brand whose focus is to help you achieve your dreams of homeownership and beyond. - INDUSTRY-LEADING TOOLS

Our cutting-edge tools, technology and resources will allow affiliated agents the ability to help guide you through your transaction with ease. - PART OF A FAMILY

As part of a great Better Homes & Gardens family, affiliated Better Homes and Gardens Real Estate agents are a step ahead on things such as interior design, outdoor design and lifestyle trends and can share this with you to help you live your best life. - TOP SEARCH ENGINE RESULTS

Better Homes and Gardens Real Estate listings are prominently displayed on major search platforms, and affiliated agents can promote these listings through a highly targeted digital marketing campaign to ensure they are seen by thousands of potential buyers. - A BRAND WITH A SOUL

We are fueled by the desire to make a difference in our community and the world community. The Better Homes and Gardens Real Estate network has teamed up with New Story, a charity devoted to building life-changing homes for impoverished families in El Salvador. - FACILITATING A STRESS-FREE MOVE

When you work with an affiliated Better Homes and Gardens Real Estate agent, you have access to amazing discounts from companies like PODS®, Mohawk® Flooring, and ADT that you can use to help with your transition into your next home.

©2024. Better Homes and Gardens Real Estate LLC. All Rights Reserved. Better Homes and Gardens®, the Better Homes and Gardens Real Estate Logo, BHGRE, Be Better and Expect Better are service marks owned by Meredith Corporation and licensed to Better Homes and Gardens Real Estate LLC. Better Homes and Gardens Real Estate LLC fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. Each franchise is independently owned and operated. The above companies are independently owned and operated from Better Homes and Gardens Real Estate LLC and Realogy Holdings Corp. and are the owners of their respective marks and logos.

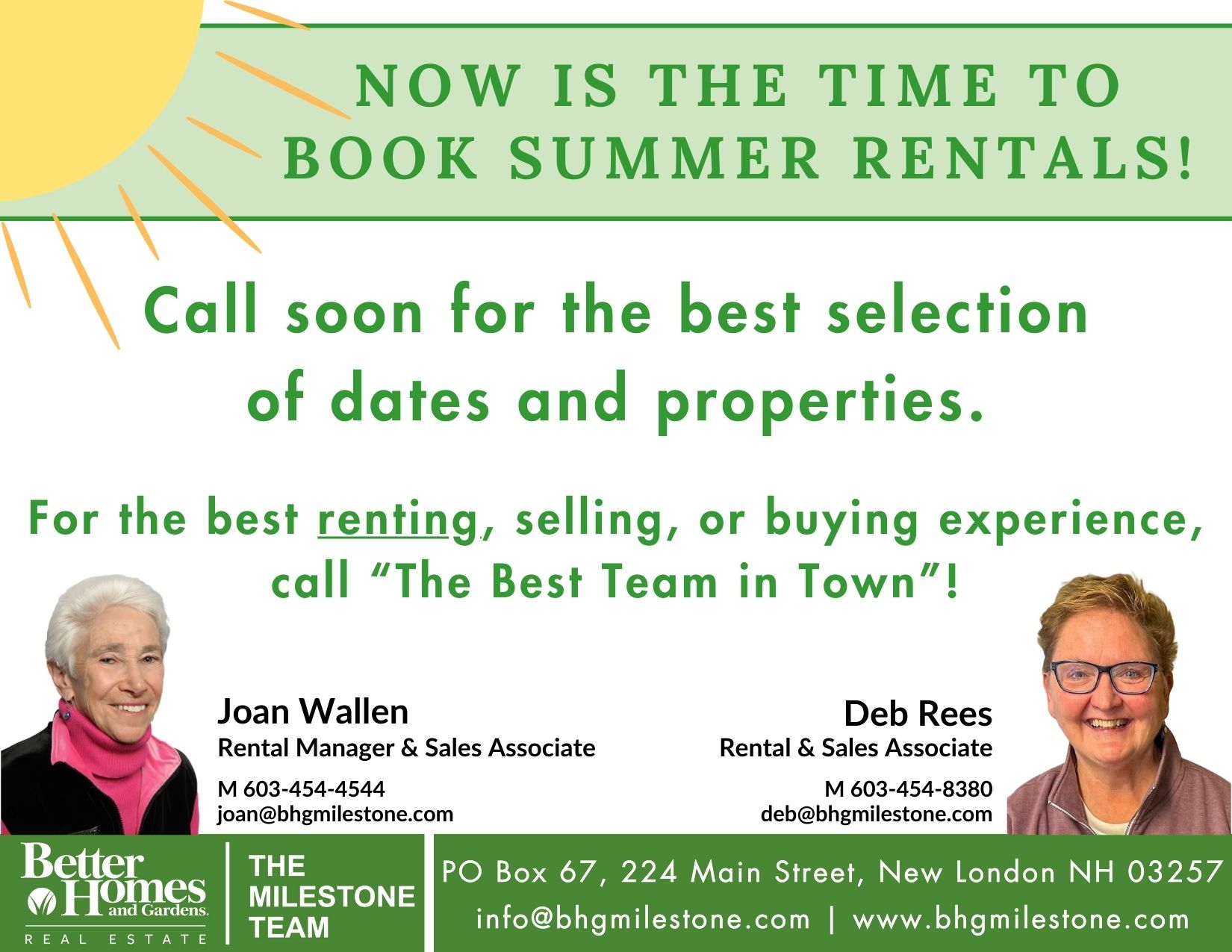

For the best renting, selling, or buying experience, call "The Best Team in Town" at 603-526-4116! Or visit our rental page!

The real estate market is ever-changing. Though the real estate transaction has not changed, it is still an intricately detailed process that needs many hands to complete. We highly encourage sellers to offer contribution to a buyer‘s agent fees, as part of this very involved transaction.

Fact: The real estate transaction is one of the most complicated and regulated consumer transactions. The average conventional buyer will need to spend at least $75,000* to purchase your home between their down payment, financing closing costs and related moving expenses. *National Association of Realtors & Mortgage Bankers Association

Fact: Homebuyers work with exceptional buyer agents, typically for long periods of time, and need to ensure their fee is paid as well. A seller that can offer a level of certainty and transparency surrounding the process and buyer representation fees will appeal to more buyers in marketing their home.

Key takeaways to consider:

- Proper representation of buyers leads to smoother transactions, reduced risk during and after closing, as well as a better overall experience for all.

- There will always be a competitive advantage to the seller that offers to participate in buyer representation fees, as it adds a level of transparency and clarity to potential buyers.

- Buyer broker fees may ultimately be negotiated as a sales concession.

For the best renting, selling, or buying experience, call "The Best Team in Town" at 603-526-4116! Or visit our rental page!

267 King Hill Road, New London, NH 03257 | Offered at $349,500 | MLS#4993289

Classic Charming Bungalow style home, in New London with gentle sloping yard. Newly renovated with wide pine floors, kitchen cabinetry featuring quartz countertops, and updated bathroom. The main floor features a large kitchen and 3/4 bath with laundry, cozy and airy living room with plenty of space to entertain, and "catchall" bonus room or sunroom. The 2nd level has 1 spacious bedroom and generous closet. Near skiing, hiking, as well as restaurants, breweries and the like. Close to I-89. Agent Interest.

For More Information Contact:

|

Lauren ChadwickListing AgentW (603) 526-4116 lauren@bhgmilestone.com |

1052 Lake Shore Drive, New London, NH 03257 | Offered at $297,000 | MLS# 4992931

Location location location! Sweet small cottage seeking new owner to love and cherish her. She needs some tender loving care to bring out the best she has to offer. The town beach on Pleasant Lake is .7 miles down the road and the center of New London is only a couple of miles away.

For More Information Contact:

|

Jane SnowListing AgentM (603) 493-4241 jane@bhgmilestone.com |