Let your property earn money for you! For the best renting, selling, or buying experience, call "The Best Team in Town" at 603-526-4116! Or visit our rental page!

267 King Hill Road, New London, NH 03257 | Offered at $349,500 | MLS#4993289

Classic Charming Bungalow style home, in New London with gentle sloping yard. Newly renovated with wide pine floors, kitchen cabinetry featuring quartz countertops, and updated bathroom. The main floor features a large kitchen and 3/4 bath with laundry, cozy and airy living room with plenty of space to entertain, and "catchall" bonus room or sunroom. The 2nd level has 1 spacious bedroom and generous closet. Near skiing, hiking, as well as restaurants, breweries and the like. Close to I-89. Agent Interest.

For More Information Contact:

|

Lauren ChadwickListing AgentW (603) 526-4116 lauren@bhgmilestone.com |

1052 Lake Shore Drive, New London, NH 03257 | Offered at $297,000 | MLS# 4992931

Location location location! Sweet small cottage seeking new owner to love and cherish her. She needs some tender loving care to bring out the best she has to offer. The town beach on Pleasant Lake is .7 miles down the road and the center of New London is only a couple of miles away.

For More Information Contact:

|

Jane SnowListing AgentM (603) 493-4241 jane@bhgmilestone.com |

Since the announcement of the proposed settlement with the National Assoc. of Realtors (NAR), the media has erroneously made several claims about what it means for sellers and buyers. Below are some thoughts to help clarify.

- The settlement does not lower home prices. Home values are based on supply and demand - not what a seller pays for commission. Prices have increasingly gone up because there are fewer homes for sale and more buyers.

- There is no mandate on what Realtors can charge for their professional services. Commissions have always been negotiable. What will change is the offer of compensation to a buyer's agent can't be posted in the MLS.

- Sellers can elect not to pay buyer agent compensation. However, buyers may write into any offer a contingency requiring the seller to cover the cost or other concessions to compensate what they pay their buyer agent.

- Written buyer agency agreements will now be required for all Realtors working with buyers. NH has been requiring this for many, many years.

"This will be a time of adjustment, but the fundamentals remain: Buyers and sellers will continue to have many choices when deciding to buy or sell a home, and NAR members will continue to use their skill, care and diligence to protect the interest of their clients."

Contact me if you would like to work with a Realtor who will always look after your best interests and consistently stays on top of the changing real estate landscape.

|

Donna ForestM: 603-731-5151donna@donnaforest.com Follow her on Facebook |

Because we ARE a TEAM collaborating for the benefit of all our clients.

200+ years of experience gives us a big edge in problem-solving.

Our team environment results in more creativity and innovative thinking.

PLUS, there is always someone available who knows who you are and can help.

Whether buying, selling, or renting call "The Best Team in Town"!

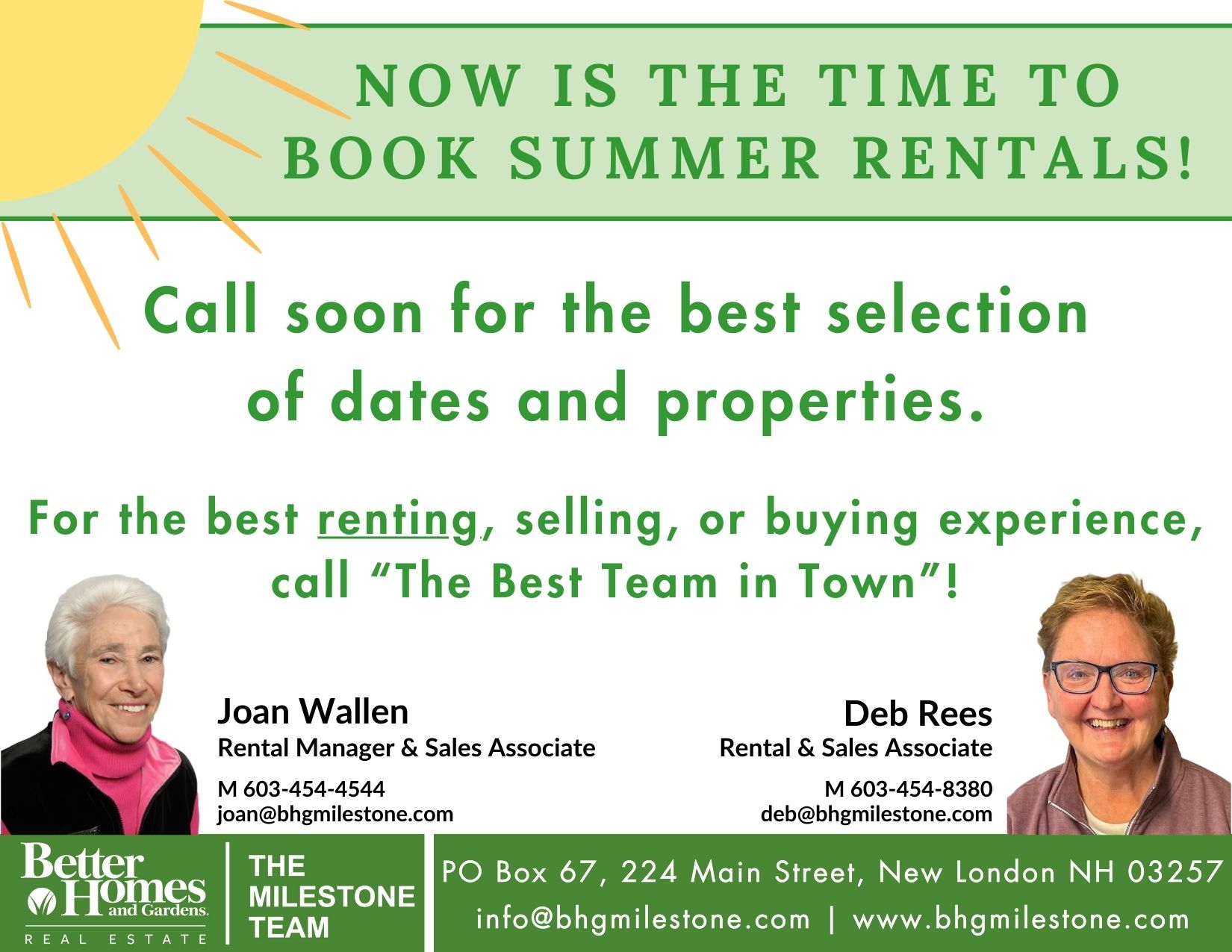

Let your property earn money for you! For the best renting, selling, or buying experience, call "The Best Team in Town" at 603-526-4116! Or visit our rental page!

16-65&67 Bagley Hill Road, Warner, NH 03278 | Offered at $109,000 | MLS #4988626

12.6 acres total consisting of two separate lots of record. Well-cared-for land in a very private setting in Warner. This property is located directly across the road from MLS #4987872. It is in a great location up near the top of Bagley Road, a town-maintained Class V road off Rte. 103. Bagley Road turns into a Class VI road just past the property line. With the extension of the road, the area offers lots of recreational opportunities. There are lovely distant views of local hills. Under 10 minutes to Exit 9 on I89 and not that much further to Lakes Todd and Sunapee with Mt. Sunapee Resort not far beyond. A professional timber harvest was done over 2017-18. The harvest consisted primarily of cordwood, white pine, oak and hemlock.

For More Information Contact:

|

Emily CampbellListing AgentM 603-491-4024

|

16-66 Bagley Hill Road, Warner, NH 03278 | Offered at $152,000 | MLS #4987872

28+ acres of nice, well-cared-for land in a very private setting in Warner. It is in a great location up near the top of Bagley Road, a town-maintained Class V road off Rte. 103. Bagley Road turns into a Class VI road just past the property line. There are lovely distant views of local hills. With the extension of the road, the area offers lots of recreational opportunities. Under 10 minutes to Exit 9 on I89 and not that much further to Lakes Todd and Sunapee with Mt. Sunapee Resort not far beyond. A professional timber harvest was done over 2017-18. The harvest consisted primarily of cordwood, white pine, oak and hemlock.

For More Information Contact:

|

Emily CampbellListing AgentM 603-491-4024

|

Lot 7 Wilder Lane, New London, NH 03257 | Offered at $195,000 | MLS#4932888

Excellent opportunity to build your dream home in Shaker Pines on Wilder Lane, a well-established neighborhood of custom homes. Wilder lane allows you the lifestyle of a quiet country road yet close to the Lake Sunapee Country Club and the town of New London. Custom design available that could be built on this beautiful lot. Four-bedroom state approved septic system available. Agent Interest.

For More Information Contact:

|

Lauren ChadwickListing AgentW (603) 526-4116 lauren@bhgmilestone.com |